Improve Employee Benefits Without Increasing Healthcare Costs

A preventive care and wellness program that helps employers enhance benefits and improve payroll efficiency — without changing existing health insurance.

Lower payroll tax exposure

No out-of-pocket cost to employees

Upgrade benefits without raising premiums

CLICK BELOW TO WATCH FIRST!

Used by employers to find hidden payroll savings

Why Employers Are Re-Evaluating Benefits

Employers are under increasing pressure:

Health insurance costs continue to rise

Employees expect more support beyond traditional coverage

Raising wages isn’t always sustainable

Many benefits don’t improve retention or utilization

The Preventative Care Management Program (PCMP) offers a comprehensive range of benefits aimed at improving employee health, promoting financial wellness, and generating savings for employers.

Ignite Primary Benefits

WELLNESS & PREVENTATIVE BENEFITS

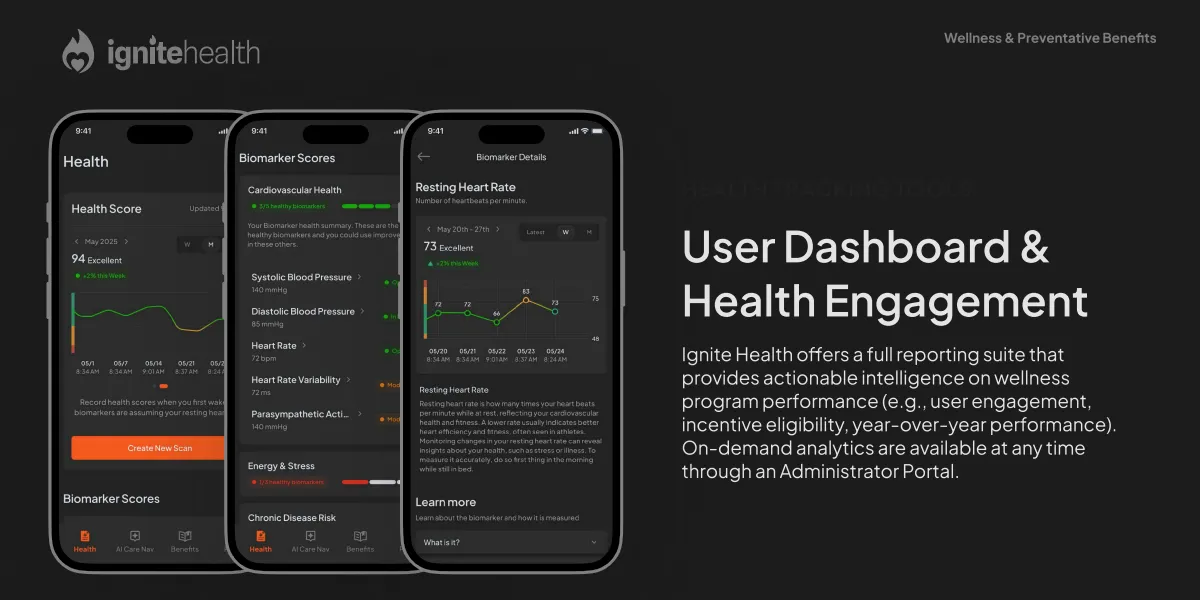

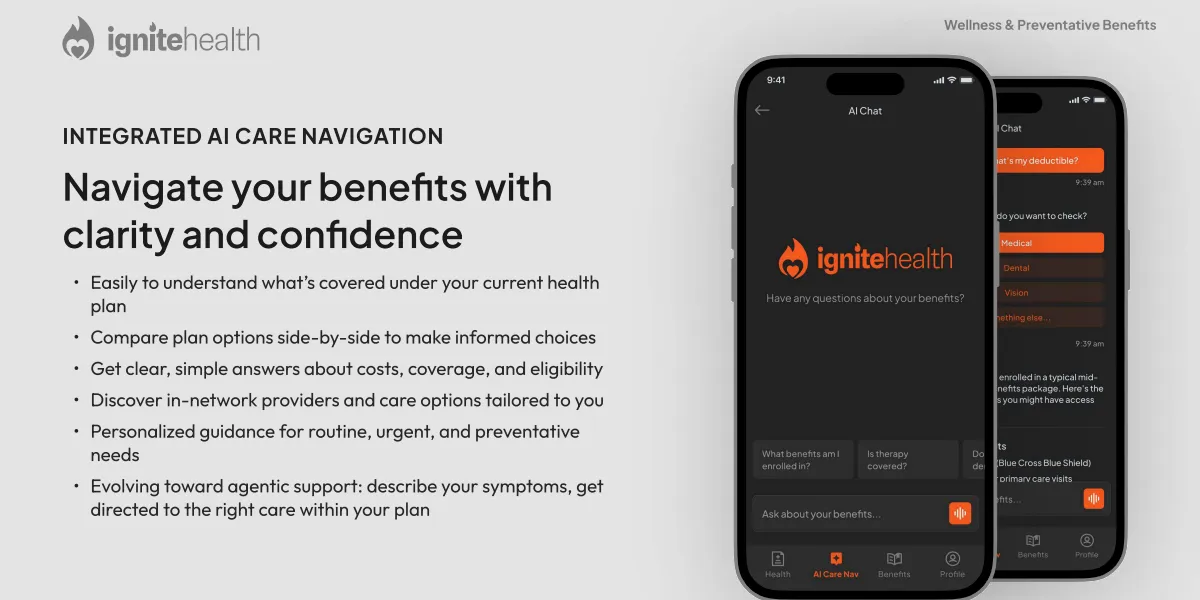

Ignite Health Platform

Access behavior tools, risk resolution guides, health tracking, videos, and resources — all in one hub.

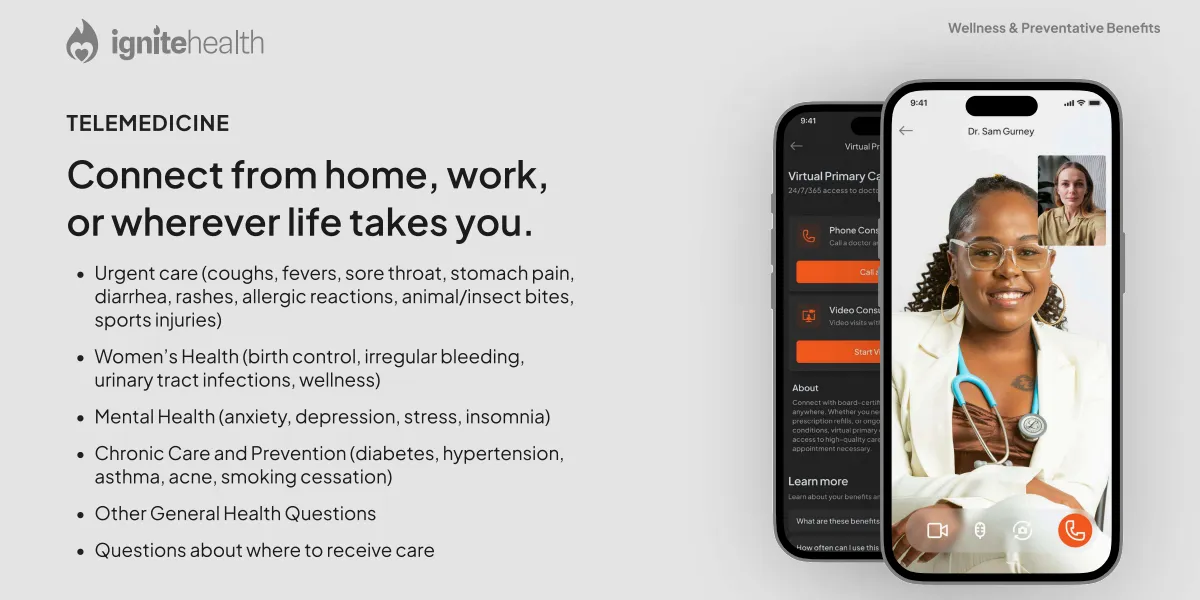

Telemedicine

Unlimited virtual visits with licensed practitioners, available 24/7/365 for the whole family — with no copay.

Wholestic™ Coaching

Unlimited nurse-led coaching to help you and your family understand, manage, and improve overall health.

Mental Health & Wellness Support

Screenings and counseling for depression, substance use, and behavioral health — promoting long-term mental well-being.

Women’s Health Benefits

Comprehensive women’s care including mammograms, Pap tests, prenatal and reproductive health, and cancer prevention.

Comprehensive Health Screenings

Routine checks for cancer, diabetes, hypertension, cholesterol, and obesity — to detect, manage, and prevent health issues early

Preventive Care & Immunizations

Free vaccines (flu, HPV, shingles, and more) plus screenings for blood pressure, cholesterol, and diabetes.

Employee Assistance Program

Confidential support for work-life balance, stress, and resilience — at no cost to employees.

Prescription Drug Coverage

Free prescriptions for employees and families, covering 1,000+ medications at 70,000+ pharmacies nationwide.

Please Note – These benefits are only a portion of the 19 total Mayo Clinic benefits included in the Preventative Care Management Program.

All associated benefits are included at no out-of-pocket expense to the employee, and do not include any individual co-pay.

A Smarter Way to Deliver Preventive Care

The Preventive Care Management Program (PCMP) is a structured wellness and preventive care program designed to support employee health while improving payroll efficiency.

The program is built to:

Improve the employee benefit experience

Reduce unnecessary payroll tax exposure

Operate alongside existing health insurance, not replace it

All eligibility, compliance, payroll coordination, and employee enrollment are handled by the program administrator.

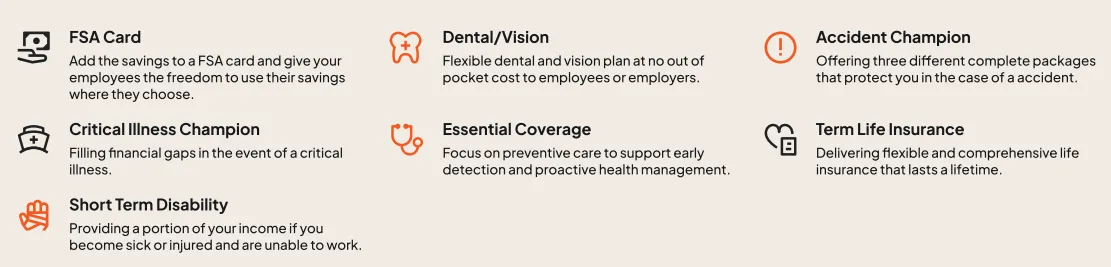

Supplemental & Essential Benefits

Supplemental & Essential Benefits

We support individuals and their families during challenging times by offering policies that provide essential coverage and cash benefits for covered accidents and illnesses. These benefits are designed to help ease financial burdens and provide the support you need when it matters most.

How The Program Works

1. Review

Review Your Workforce & Payroll

Share a recent payroll report and a few details about your team so we can assess fit and estimate potential savings under a compliant Section 125 structure.

You’ll see how preventive care and wellness can be funded by reallocating existing payroll tax dollars, not adding new benefit spend.

2. Design

Design Your Preventive Care Program

If there is a fit, the program administrator builds a customized preventive care and wellness plan that runs alongside your current health insurance.

All eligibility, compliance, and payroll coordination are handled for you, so your HR and finance teams are not burdened with extra administration.

3. Implement

Implement, Enroll, and Realize Savings

Employees are enrolled into the program and gain access to expanded preventive, mental health, and telemedicine benefits with no reduction in net take-home pay.

You begin seeing improved benefits and potential payroll tax efficiencies, supported by ongoing administration and reporting from the third-party specialist.

Ready to get started?

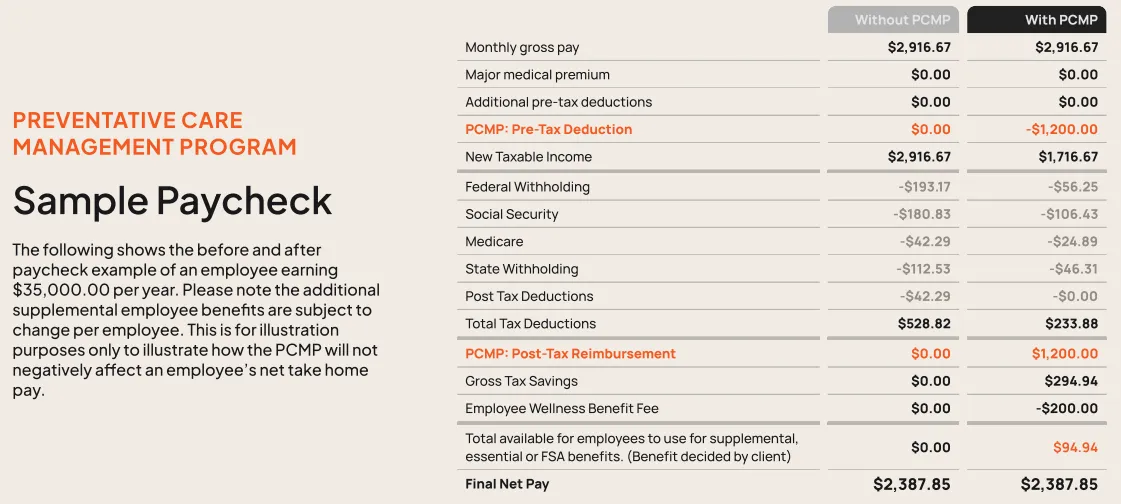

How the Program Is Funded

PCMP is funded through existing payroll tax savings, not increased healthcare spend.

By structuring eligible preventive care benefits through a compliant framework:

Employers may reduce payroll tax liability

Employees receive expanded benefits

No increase in premiums or wages is required

Payroll impact and examples are reviewed in advance, so employers can clearly see how the program works before making any changes.

Who Typically Benefits Most

This program is often a good fit for employers with:

10–250 W-2 employees

Payroll-heavy or hourly workforces

Rising benefit or payroll pressure

An interest in retention and cost control

Common industries include trades, manufacturing, hospitality, healthcare practices, professional services, and multi-location businesses.

What the Review Process Looks Like

Book a short benefits review call

Eligibility and workforce fit are reviewed

Payroll examples are shared before implementation

You decide whether to move forward

No pressure. No obligation.

See If This Makes Sense for Your Business

The benefits review call is a working session — not a sales pitch.

You’ll get clarity on fit, funding, and next steps.

TESTIMONIALS

What others are saying

Frequently Asked Questions

Does this replace our current health insurance?

No.

The Preventive Care Management Program is designed to run alongside your existing health insurance, not replace it.

The program includes Minimum Essential Coverage (MEC) as part of the overall structure, which supports access to preventive care and ACA alignment. However, it is not major medical insurance and does not replace your current health plan or broker relationships.

Will this increase our healthcare costs or premiums?

No.

The program is designed to improve benefits without increasing healthcare premiums or total benefit spend. It is funded through existing payroll tax savings, not new employer contributions.

Payroll examples are reviewed in advance so you can clearly see the impact before making any decisions.

Does this reduce employee take-home pay?

No.

The program is structured so employees receive access to expanded preventive and wellness benefits without a reduction in net take-home pay.

This is reviewed and confirmed during the onboarding process before anything is implemented.

Is this complicated to administer or manage internally?

No.

The program is administered by a third-party specialist who handles:

Eligibility review

Compliance

Payroll coordination

Employee enrollment

Employers are not responsible for day-to-day administration or employee benefit questions related to the program.

What is the next step if we want to explore this?

The next step is a short benefits review call.

During that call, the administrator:

Reviews eligibility and workforce fit

Explains how the program works alongside your current benefits

Walks through payroll examples

There is no obligation to move forward after the review.

Still have questions?

The benefits review call is the fastest way to determine whether this makes sense for your business.

This program is designed to operate within applicable IRS and ACA regulations. Participation depends on eligibility and proper administration. This information is not tax or legal advice.